代表工程

新闻资讯

企业概况

开云手机站登录入口-开云online(中国),座落于青山绿水的铜陵市东润大厦,公司于2011年6月注册成立,公司注册资金1500万元。

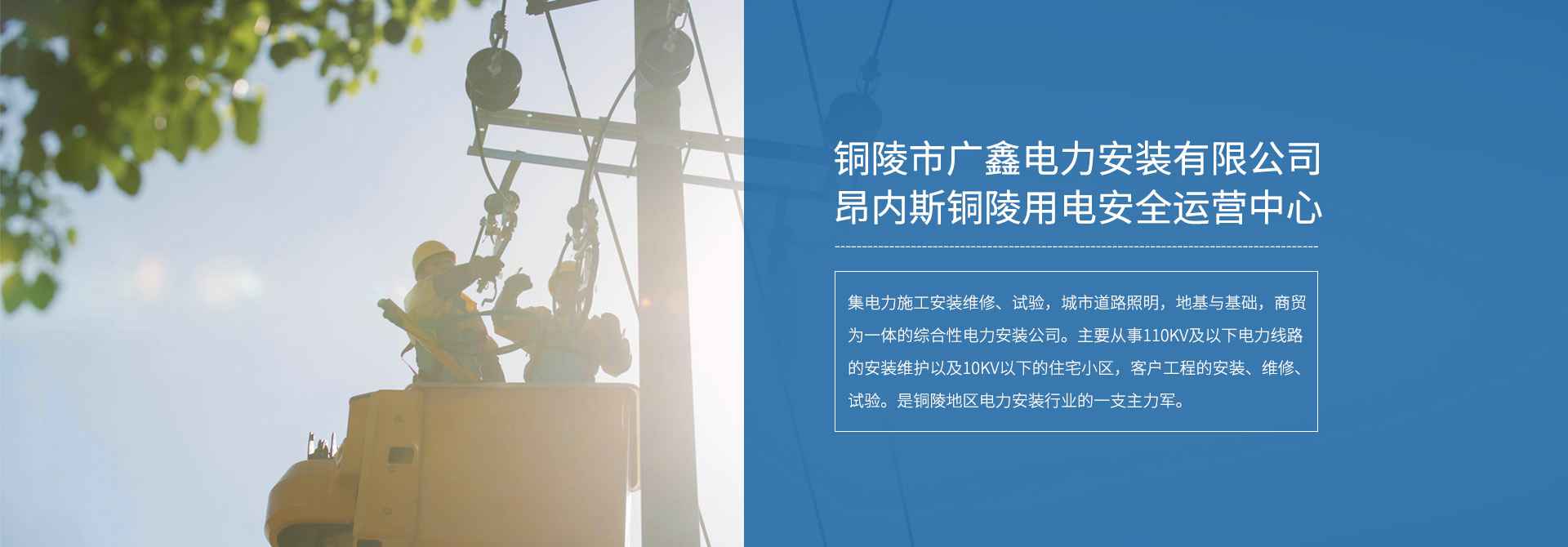

公司下设6个职能科室,1个运营中心。是集电力施工安装维修、试验,城市道路照明,地基与基础,商贸为-一体的综合性电力安装公司。主要从事110KV及以下电力线路的安装维护以及10KV以下的住宅小区,客户工程的安装、维修、试验。是铜陵地区电力安装行业的一支主力军。

公司质量管理体系通过了IS0 9001质量管理体系认证。公司施工能力强,技术力量雄厚,人员素质高,现已拥有众多工程技术人员和管理人员,专业的施工队伍,所有人员均持有国家相关部门颁发的执业资格证书上岗。

公司秉承“以质量求生存,以诚信求发展,以安全求效益,以优良服务积极参与市场。”与时俱进,不断开创广鑫电力安装的光明未来。永做铜陵地区用电安全的小卫士。